In the News

How to Deactivate Facebook

April 23 By Zach Taras, Nathan Chandler

5 Tips on Sneaker Rehab From a Sneaker Restoration Expert

April 16 By Alia Hoyt

Yours, Mine or Ours? Leaf Blowing and the Law

April 16 By Laurie L. Dove

Germs May Help Shape Our Personalities

April 16 By Julia Layton

Gigantic Undiscovered Cave Found in British Columbia

April 16 By Patrick J. Kiger

Ghost in the Machine: When Does AI Become Sentient?

April 16 By Chris Pollette

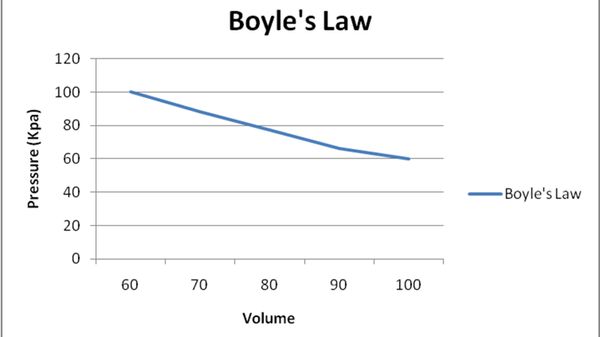

Science

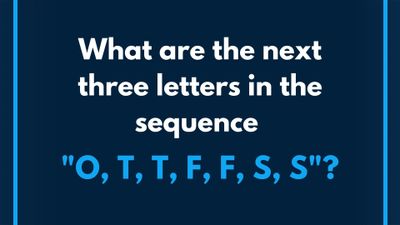

10 Scientific Words You're Probably Using Wrong

The Secrets of Airline Travel Quiz

How Long Does It Take to Get to the Moon?

How Do QR Codes Work? 2D Barcodes Explained

Culture

Audie Murphy, From World War II Hero to Hollywood Hitmaker

Why Was the Mad Hatter Mad?

10 Worst Ways History Has Repeated Itself

What Was Japanese Emperor Hirohito's Role in World War II?